|

ROLLOVER

CENTER |

| |

|

| STIFEL |

Retirement |

| NICOLAUS |

Plans Quarterly |

1st Quarter 2009 |

First Quarter 2009

IRAs FOR 2008 AND 2009

Contributions to traditional and Roth IRAs for the

2008 tax year can be made until (and including) Wednesday, April 15,

2009. Contributions to traditional or Roth IRAs are limited to the

lesser of 100% of earned income or $5,000 ($6,000 age 50 or older) for

2008 and 2009. In addition, a spousal contribution may be made to an

IRA established for a spouse with little or no earned income if the

married couple files a joint tax return. The spouse receiving the

contribution must be under the age of 70 � for the year in which the

contribution is made (applies to traditional IRA, not Roth IRA).

Traditional IRA Deductibility

The tax deduction for a traditional IRA contribution

is based on whether an individual is an "active participant" in a

qualified retirement plan (QRP), 403(b), SEP, or SIMPLE IRA. If so,

the individual�s tax return filing status and their adjusted gross

income (AGI) are considered. If a single individual is not an active

participant, contributions, regardless of the individual�s income, are

fully deductible. For married couples filing a joint return, if

neither spouse is an active participant in a plan, contributions for

each are tax-deductible.

Single filers

If a single individual is an active participant and

has AGI of $53,000 ($55,000 for 2009) or less, his or her contribution

is fully deductible. A partial deduction is allowed if the AGI is

between $53,000 and $63,000 ($55,000 - $65,000 for 2009).

Married filers

treated independently

If one spouse is an active participant

and the other is not, both individuals� deductions are subject to

different AGI limits. For the spouse who is an active participant, a

fully deductible 2008 contribution is allowed with joint AGI of

$85,000 ($89,000 for 2009) or less. A partial deduction is available

for AGI between $85,000 and $105,000 ($89,000 - $109,000 for 2009).

The spouse who is not an active participant may make a fully

deductible 2008 contribution if the couple�s AGI is $159,000 ($166,000

for 2009) or less. A partial deduction is allowed if their AGI is

between $159,000 and $169,000 ($166,000 - $176,000 for 2009).

Roth contributions

Contributions to Roth IRAs are always

non-deductible, and the following income levels apply.

�

Single individuals

are eligible to make a maximum

contribution for 2008 if their AGI does not exceed $101,000

($105,000 for 2009). Partial contributions are allowed for AGI

between $101,000 and $116,000 ($105,000 - $120,000 for 2009).

�

Married couples

filing jointly are eligible to

make a maximum contribution for 2008 if their AGI does not exceed

$159,000 ($166,000 for 2009). A partial contribution may be made

if AGI is between $159,000 and $169,000 ($166,000 - $176,000 for

2009).

Note that the aggregate total

of all contributions to both traditional and Roth IRAs may not exceed

$5,000 per individual or $10,000 per married couple, plus catch-up

contributions, if applicable.

Now is the season to make contributions to IRAs for

2008. Why not think about making a 2009 contribution at the same time?

|

|

|

|

|

|

|

REQUIRED MINIMUM DISTRIBUTIONS (RMDs) SUSPENDED

FOR 2009

On December 23, 2008, President Bush signed into

law, The Worker, Retiree, and Employer Recovery Act of 2008, which

includes a provision that provides relief by suspending the 50%

penalty for failing to take RMDs for 2009. This one-year

suspension includes RMDs from IRAs and employer-sponsored defined

contribution retirement plans for account owners and

beneficiaries.

How This Affects RMDs

Generally, IRA holders and participants in

employer-sponsored contribution plans (who are 5% or greater

owners of the business) who are over the age of 70 � are required

to withdraw a portion of their IRA or plan assets each year to

satisfy their RMD. Failure to do so can be costly, as the IRS

imposes a 50% penalty on the required amount if not taken by the

due date. However, the 50% penalty is waived for 2009 RMDs. This

means that those individuals who are scheduled to take an RMD for

2009 may choose to skip the distribution completely, or continue

to take all or a portion of the RMD for the 2009 tax year.

First Year RMDs

Note that this temporary suspension is for 2009

RMDs only and individuals that turned 70 � in 2008 and elected to

defer their first distribution to April 1, 2009, must still take

that 2008 distribution prior to April 1, 2009. On the other hand,

those turning 70 � in 2009 will be allowed to skip their 2009 RMD

and take their first RMD by December 31, 2010 (no delay to April

1, 2011 allowed for this distribution).

Beneficiaries Included

In addition to RMD waivers for IRA and plan

participants, beneficiaries who inherit deceased IRA or plan

participants� assets are also granted a 2009 RMD suspension.

Individuals currently taking periodic distributions from an

inherited IRA can stop withdrawals for 2009 and begin again in

2010, even if the first RMD would have been paid in 2009.

If the five-year payout option was previously

selected, 2009 may be excluded as one of the five years for

determining the final payout. As an example, if an IRA or

retirement plan holder died in 2008, the account balance would

have to be paid to the beneficiary by the end of the year of the

fifth anniversary of death, which would normally have occurred on

December 31, 2013. However, by eliminating 2009 as one of the

years, the balance must be paid from the inherited IRA or plan by

December 31, 2014.

RMD Plan Relief

Due

to the extraordinary economic downturn, many Americans� retirement

savings accounts have lost substantial

|

market value, and RMDs

would further deplete their tax-deferred accounts. This suspension

will allow for assets that would have been taken in 2009 to remain

in IRAs or employer-sponsored plans and was designed to provide

relief for the possibility of market value recovery.

RESPONDING TO MARKET TURMOIL

The unprecedented events

over the last several months are forcing plan sponsors and

fiduciaries to re-evaluate investment offerings and address

employees� concerns regarding the safety of their retirement

savings. Plan sponsors and fiduciaries should incorporate an

investment review, proactive employee communications, and

effective fiduciary governance controls into their monitoring

role.

Investment Review

Plan fiduciaries are

responsible for the prudent selection and monitoring of investment

options offered within defined contribution plans. Retaining an

independent third-party investment advisor to assist in reviewing

investment options on a regular basis is considered to be a best

practice. The plan sponsor should consult with the investment

advisor about changes to the investment menu, investment policy

statement, or any actions to correct deviations from the

investment policy statement.

Recent events should prompt

prudent fiduciaries to enhance steps concerning the review of

their investment options, especially investments previously

considered to be low risk. These should be carefully examined to

determine exposure to troubled or failed companies and effects of

the current financial environment and events on the investments,

such as drop in rating. Sponsors may wish to consider a special

meeting or a temporary increase in frequency of monitoring their

plans. Mergers, menu changes, and any other previously planned

items should be evaluated in light of the economy. Many plan

sponsors are now considering the addition of an "income for life"

type of investment option.

Proactive Employee Communication

Plan sponsors and

fiduciaries should educate participants on the generally accepted

investment principles such as diversification, risk tolerance,

time horizon, etc. In addition, providers and advisors should also

make available resources to address the need to save, the benefits

of doing so, and tools to help gauge retirement income needs.

Many employees undoubtedly

will have questions and concerns about how the current credit and

financial crisis will affect their retirement savings, and those

employees nearing retirement may express heightened concerns.

Fiduciaries and plan sponsors may want to communicate with

employees now more than ever to allay their fears and leverage

these unfortunate events to remind employees about the importance

of

|

|

|

|

diversification, rebalancing, and dollar cost averaging and to

discourage them from making emotional decisions to stop or reduce

contributions. Of course, it should be noted that diversification

and dollar cost averaging do not ensure a profit and may not

protect against loss in a declining market. For dollar cost

averaging to be effective, investors must continue investing

during periods of falling prices.

Many providers have developed special materials

and frequently asked questions (FAQs) as a means of addressing

these current events in a timely manner. Plan sponsors should

consider special education sessions regarding the plan�s risk

features and to assure participants that events are being

monitored. It would also be prudent to review existing plan

communication pieces and investment fact sheets to determine if

descriptions of the plan�s investment choices and their related

risk factors need to be revised in light of the recent upheaval in

the financial markets.

Fiduciary Governance

A

fiduciary must demonstrate prudence by the process through which

investment selections, investment monitoring, fee oversight, and

other plan decisions are made. A well-defined and thoroughly

documented process can be a significant defense tool. Other best

practices would be to identify parties-in-interest and

disqualified persons and their affiliates while looking out for

conflicts of interest on all transactions, paying special

attention to conflicts in advisor and fee arrangements. As always,

plan sponsors should document any advice received and all actions

taken.

During times of economic turmoil, fiduciaries

may want to more frequently monitor investments as well as review

previously selected Qualified Default Investment Alternatives to

determine if they are still prudent. The plan�s policies,

procedures, and operation should be regularly audited.

Additionally, fiduciaries should evaluate all service agreements

with special emphasis on termination provision, indemnification

provision, and all fees charged. They should determine if any

service providers (trustees, investment managers, TPAs) have been

affected by the recent economic events and consider if action is

necessary.

Times of crisis create an even greater need for

plan sponsors to carefully evaluate all aspects of their plan and

to communicate frequently with plan participants.

DOWN MARKETS CAN BE AN OPPORTUNITY FOR 401(K)

INVESTORS

We have all heard the media using phrases like

"the market plummets," "investors panic," and comparing today�s

circumstance to �The Great Depression.� But is this a valid

comparison? Yes, there are some likenesses: unemployment was high

(a staggering 25% during the Depression, today it�s at 7.6% 1);

|

banks were failing (then 26% of banks failed,

today the number is 0.17% 2); and of course, a volatile

market (S&P 500 losing 71% between 1929 and 1933; and in 2008, the

market ended down 38.49%3).

What Should I Do?

Various decisions affect

the growth of your retirement account, such as: how much you defer

from your paycheck, where your account is invested, the years in

which you are in the market, whether the market produces

returns/losses over those periods, etc. In times like this when

the investment market is in decline, it is easy to say, "I will

just stop contributing to the plan until the market gets better."

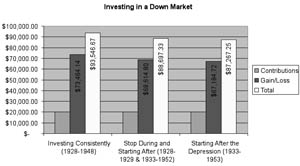

Below is a chart that shows

three different participants saving $1,000 each year for 20 years,

with the performance of their portfolios being tracked until March

1960. Market performance is based upon the S&P 500. Participant A

started saving in March of 1928 (prior to the Great Depression and

at the peak of the market) and continued to invest all the way

through the Great Depression. Participant B also began saving in

March 1928, but stopped investing from 1929 - 1932 and then got

back into saving in January 1933. Participant C began investing

January 1933, just after the end of the Great Depression. So, how

well did each participant�s 401(k) account weather the worst

market in history.

This is a hypothetical illustration and is

not intended to portray the results of any particular investment.

Indices are unmanaged and you cannot invest directly in an index.

Conclusion: Participant A

emerges victoriously, and as a reward for his/her unwavering

investment strategy a $5,000 gain was recognized over Participant

B and a $6,000 gain over Participant C. By not letting the media

or emotions take precedent over a sound investment approach, this

downturn in the market could turn out to be one of opportunity

rather than despair.

1 Department of Labor, Bureau of Statistics

2 J.R. Walter, Depression Era Bank Failures

3 Standard & Poor�s

Written by Jillian Grimm, Client Service

Associate, on behalf of Doug Prince, Senior Vice President /

Investments, Stifel, Nicolaus & Company, Incorporated,

Indianapolis, Indiana, (317) 571-4560.

|

|

|

|

FORM 5500 CHANGES IN STORE

Last year, the U.S. Department of Labor�s (DOL)

Employee Benefits Security Administration, the Internal Revenue

Service, and the Pension Benefit Guaranty Corp. (PBGC) announced

the publication of revisions to the Form 5500 annual

return/report. The DOL�s goal is that plan sponsors will have a

firmer grip on the information concerning their plan�s investment

costs, including payments to service providers and other plan

intermediaries.

Illustrated below are changes to Form 5500,

schedules and filing process, and types of plans impacted. Plan

types that may be impacted by these changes include: Defined

Benefit (DB), Employee Stock Option (ESOP), Defined Contribution,

Money Purchase, Small Plan (under 100 employees), Large Plan (over

100 employees), and EZ 5500 filers (owner(s) & spouse(s)). Most

changes are effective for plan year 2009, unless otherwise noted.

Form 5500 � The main body of

the Form provides a detailed annual report of plan and participant

information. The changes to the main body of the Form include:

� An electronic filing is required for all plans

� ERISA 403(b) plans are now required to file a Form 5500

� An independent audit is required for large (over 100

employee) ERISA 403(b) plan filers

� EZ 5500 new short form � all plan types and less than 100

employees.

� New question added for multi�employer plans � only

affects DB Plans, except those which are EZ 5000 filers.

� Short plan year filers required to attach a Schedule SB

(single�employer plans) or MB (multi�employer plans) will be

granted an automatic Form 5500 filing extension of 90 days

after 2008 Forms become available (2008 only) � affects single

or multi�employer DB Plans, except for EZ 5500 filers.

Schedule A � reports information on insurance

company-held assets.

- A new line for reporting the failure of an insurance

company to provide information � does not apply to Money

Purchase or EZ 5500 filer plans.

Schedule B � reports actuarial information.

- This schedule is now replaced with Schedule SB

for single-employer plans and Schedule MB for multi-employer plans

(2008) � affects DB and Money Purchase Plans, of any size.

|

Schedule C

�

reports information on service providers and trustees,

including compensation.

- Must now include direct and indirect

compensation received by plan service providers (2009) �

excluding plans with under 100 employees and EZ 5500 filers

Schedule E

�

reports information on Employee Stock Option Plans (ESOPs).

- This schedule has now been eliminated -

three questions on ESOPs have now been moved to Schedule R.

Schedules H & I

�

reports financial information for plans with over 100

participants (H) or fewer than 100 participants (I).

- Now includes blackout notice requirements

and benefit payment failure, as well as a new attachment for

reporting delinquent participant contributions � excludes

Money Purchase and EZ 5500 filer plans.

Schedule R

�

reports plan funding and distribution information.

- Now includes ESOP

and multi-employer questions � excluding Money Purchase and EZ

5500 filer plans.

- Now includes asset allocation questions

for DB plans with greater than 1,000 plan participants (2008)

- Now includes minimum funding questions for

some Defined Contribution Plans � excludes DB, ESOP, and EZ

5500 filer plans.

Summary Annual Report

�

summarizes the asset information reported on the Schedule H

and I.

- Repealed for Plans. Information will be

added to the Annual Defined Benefit Funding Notice

Schedule SSA

�

reports separated vested participant information.

- This schedule has been removed. IRS

instructions on how to report this information is still

pending

Plan sponsors need to be

aware that additional information will now be needed in order to

complete the Form 5500 filing. Even if the plan sponsor is working

with an outside party to complete the form (e.g., third party

administrator, CPA) the new regulations reinforce the duties of

the plan sponsor. The plan sponsor has the ultimate responsibility

for the accuracy and thoroughness of the Form 5500 filing,

especially since the new changes to the form require even more

fiduciary involvement and understanding of the process.

|

|

The information

contained in this newsletter has been carefully compiled from

sources believed to be reliable, but the accuracy of the

information is not guaranteed. This newsletter is distributed with

the understanding that the publisher is not engaging in any legal

or accounting type of work such as practicing law or CPA services.

S TIFEL,

NICOLAUS &

COMPANY,

INCORPORATED

Member SIPC and New York

Stock Exchange, Inc.

National Headquarters: One

Financial Plaza � 501 North Broadway � St. Louis, Missouri 63102

(800)434-401K �

www.stifel.com

Investment Services Since 1890 |

|

|

|