ROLLOVERS TO INDIVIDUAL RETIREMENT ACCOUNTS (IRAs)

The Financial Industry Regulatory Authority (FINRA) has increased scrutiny on IRA rollover recommendations. It

issued Regulatory Notice 13-45 to remind financial firms of their responsibilities when recommending rollovers

to IRAs by employer-sponsored plan participants who are terminating employment.

Rollover considerations

Participants of employer-sponsored retirement plans [401(k), profit sharing, 403(b), etc.] typically have

several options when they terminate employment:

• Leave the money in the former employer’s plan, if permitted

• Roll over the assets to a new employer’s plan, if one is available and rollover contributions are permitted

• Distribute the assets

• Roll over assets to an IRA

Each alternative may have advantages and disadvantages, based on an individual’s needs and

circumstances, and all of the following issues or items should be carefully considered:

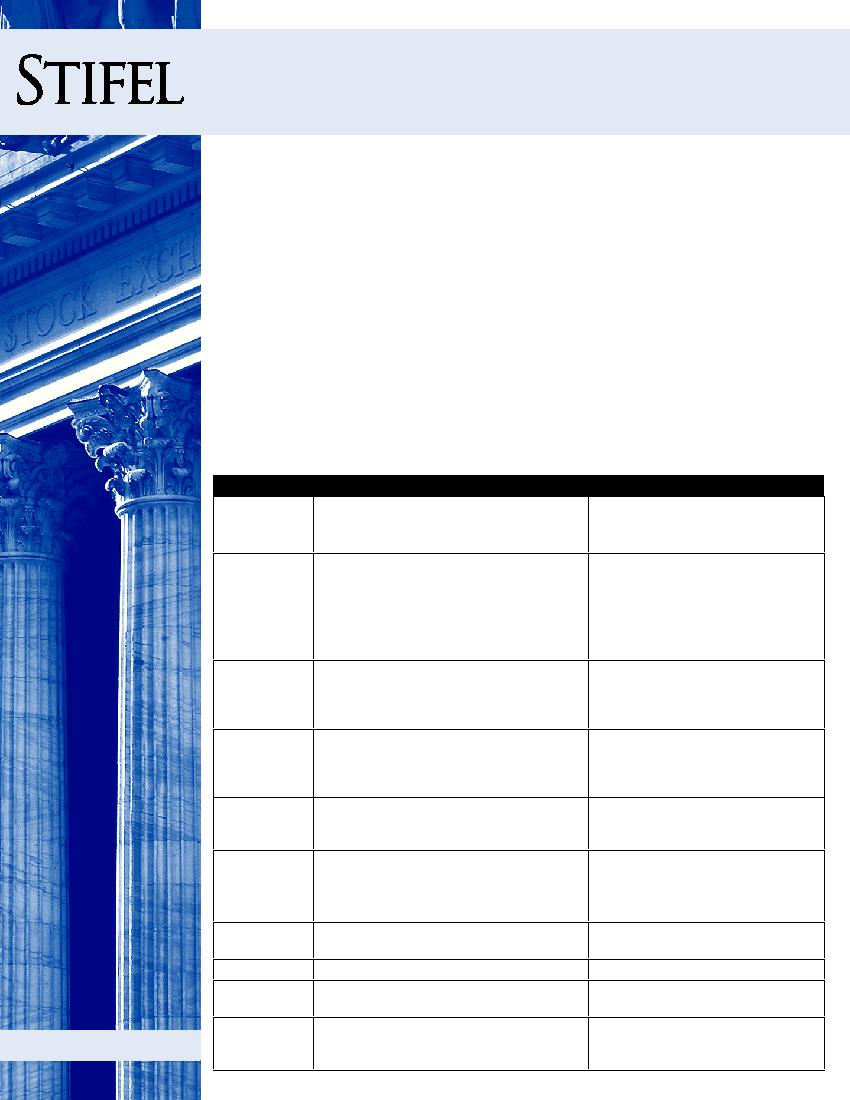

Employer-Sponsored Retirement Plan

IRA

Investments Number and type may be restricted by the plan.

If mutual funds, less expensive institutional share

class may be used.

Usually broader array of products

available.

Fees

What are investment expenses. Advisor expenses.

Are administration/recordkeeping fees charged to

participants, or does the employer pay them.

Charge for distributions to an IRA.

Annual Custodial fee.

Stifel = $40/year; $30 if multiple accounts

in a household.

Transaction and/or advisory fees that vary

depending on the product and/or program

selected.

Services

Do you have access to investment advice,

planning tools, telephone help lines, educational

materials, and workshops.

Do you have access to planning tools,

telephone help lines, and educational

materials, or advice, full brokerage

services, and financial planning.

Penalty-Free

Withdrawals

Age 59 ½. Some penalty exceptions may apply.

Age 55 if separated from service with sponsoring

employer during the year in which or after

attaining age 55.

Age 59½. Some penalty exceptions may

apply.

Taxation

Ordinary income tax assessed at distribution

(exception for Roth and after-tax contributions).

Ordinary income tax assessed at

distribution (exception for Roth and

after-tax contributions).

Required

Minimum

Distributions

(RMD)

Generally must begin at age 70 ½, but may be

delayed until retirement, if still employed by plan

sponsor and the plan allows.

RMDs may not be rolled over to an IRA.

Must begin at age 70 ½ (exception for

Roth IRAs).

Employer Stock Tax benefits available for distribution of shares of

highly appreciated stock (NUA election).

N/A

Loans

May be available while still employed.

No loans permitted.

Protection from

Creditors

Unlimited protection from creditors under federal

law.

Protection in bankruptcy proceedings only;

state laws vary.

Roth

Conversion

Plan may allow for Roth contributions and also

in-plan conversions.

Pay tax on conversion, then Roth

IRA distributions are tax-free (certain

restrictions apply).

Second Quarter 2014

Second Quarter 2014

Retirement

Plans Quarterly

2nd Quarter 2014