IRS ANNOUNCES COST-OF-LIVING ADJUSTMENTS FOR 2013

On October 18, the Internal Revenue Service announced cost-of-living adjustments applicable to dollar

limitations for plans and other items for tax year 2013. In general, many of the pension plan limitations will

change because the cost-of-living index met the statutory thresholds that trigger their adjustment. However,

other limitations will remain unchanged.

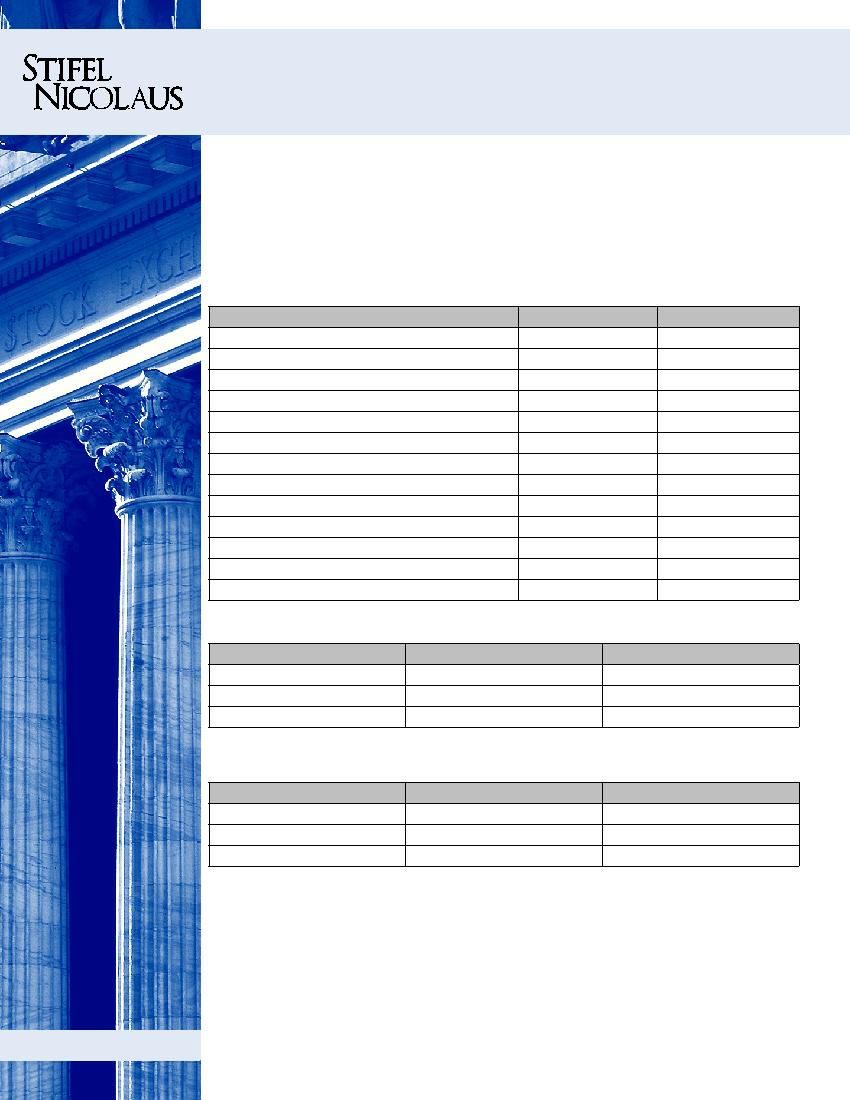

Annual Limit

2013

2012

Social Security Wage Base

$113,700

$110,100

Annual Compensation Limit

$255,000

$250,000

Key Employee Compensation Limit

$165,000

$165,000

HCE Compensation

$115,000

$115,000

Elective Deferral Limit (401(k) & 403(b) & 457)

$17,500

$17,000

Catch-up Contributions (401(k) & 403(b))

$5,500

$5,500

SEP Minimum Compensation

$550

$550

SIMPLE IRA Deferral Limit

$12,000

$11,500

Catch-Up Contributions (SIMPLE IRA)

$2,500

$2,500

IRA Contribution Limit

$5,500

$5,000

IRA Catch-Up Contributions

$1,000

$1,000

Annual DB Benefit Limit

$205,000

$200,000

Annual DC Contribution Limit

$51,000

$50,000

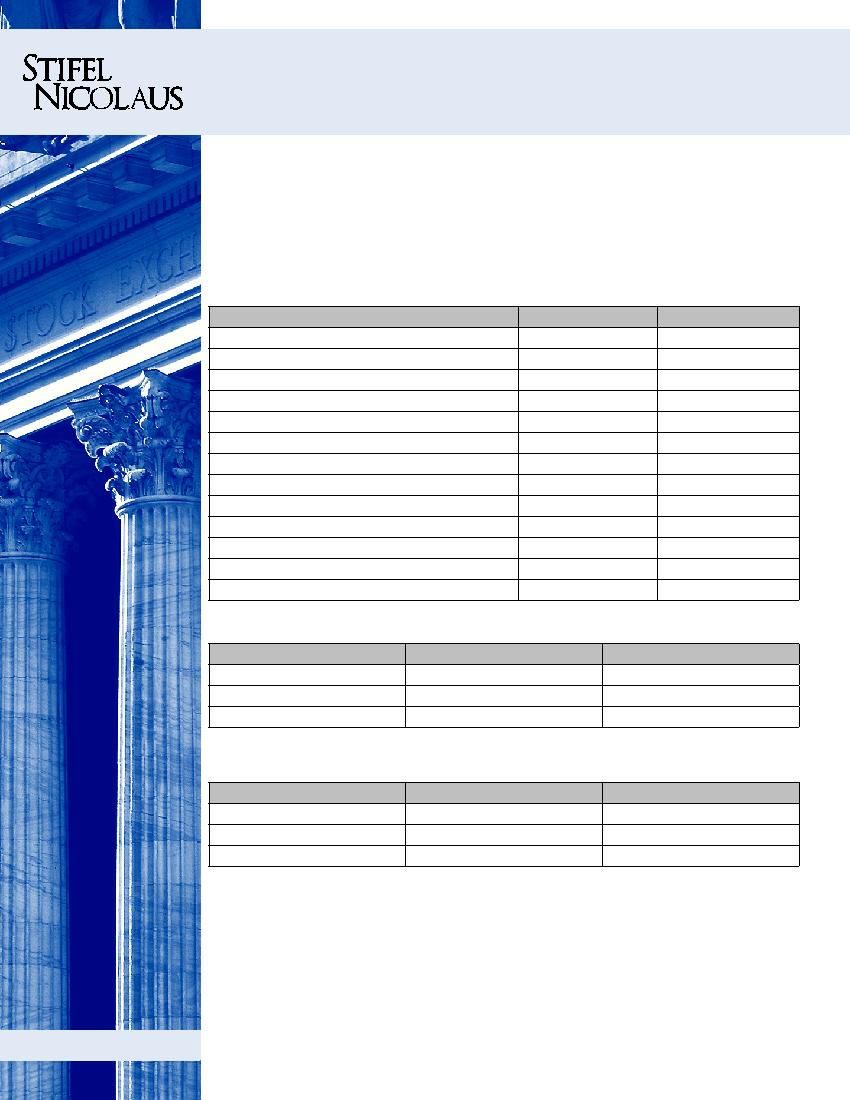

IRA deductibility and Roth IRA eligibility are as follows:

Traditional IRA Deductibility

Single Filer’s AGI:

Married Filing Jointly AGI:

Full Contribution

< $59,000

< $95,000

Partial Contribution

$59,000–$69,000

$95,000–$115,000

Not Eligible

> $69,000

> $115,000

Income limits if covered by an employer-sponsored plan. Maximum Joint Compensation for deductible

contribution by non-covered spouse: $178,000–$188,000

ROTH Eligibility

Single Filer’s AGI:

Married Filing Jointly AGI:

Full Contribution

< $112,000

< $178,000

Partial Contribution

$112,000–$127,000

$178,000–$188,000

Not Eligible

> $127,000

> $188,000

TAX CREDIT FOR RETIREMENT PLAN STARTUP COSTS

Many small businesses face a unique set of circumstances. Besides competing with other companies in selling

products or services, small businesses strive to provide employee benefits comparable with larger companies in

order to retain quality employees. A retirement plan is usually considered as part of the benefits package, but one

of the main reasons cited by small business owners for not offering retirement plans is the high costs associated

with their establishment and administration. However, small businesses that adopt a new defined contribution,

defined benefit, SIMPLE, or SEP IRA plan are allowed a tax credit of 50% of the expenses paid or incurred for

administration or retirement education. The credit applies to the first $1,000 of these qualifying expenses in each of

its first three plan years, with a maximum credit of $500 for each year.

Retirement

Plans Quarterly

4th Quarter 2012