FINAL YEAR OF ACCELERATED TAXATION FROM 2010 CONVERSIONS

Under a provision in the Tax Increase Prevention and Reconciliation Act of 2005 (TIPRA), the $100,000

AGI restriction was eliminated for Roth IRA conversions. This allows taxpayers with AGI of $100,000

or more to convert their retirement plan assets or Traditional, SEP, or SIMPLE (after two years) IRAs to

Roth IRAs.

Tax consideration

For conversions completed in the year 2010, taxes could be deferred. Unless a taxpayer affirmatively

elected full taxation in 2010, a 2010 Roth IRA conversion was taxed “ratably," by reporting 50% of the

taxable amount converted in 2011 and 50% in 2012.

Accelerated taxation for distributions

TIPRA includes a provision intended to discourage the withdrawal of converted assets until their 2011 and

2012 tax obligations were satisfied.

Under the provision, if a 2010 converted amount is subsequently withdrawn in 2010 or 2011, the amount

of the distribution must be reported as ordinary income in the year of the distribution. The same amount

must be subtracted from the income that would have been reported in the individual’s 2012 tax filing.

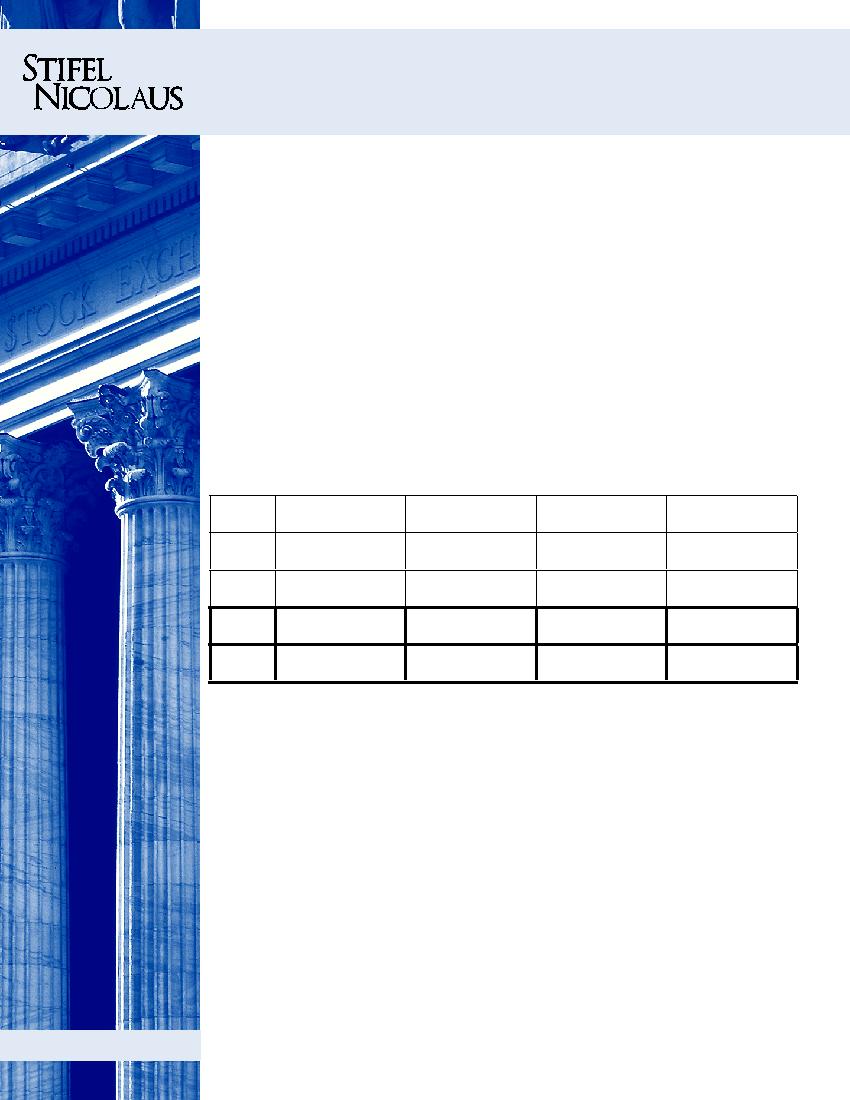

Accelerated Taxation for Distributions of 2010 Conversions

Year

Action

Income Reportable

in 2010

Income Reportable

in 2011

Income Reportable

in 2012

2010 Converted $100,000

(50/50 taxation)

$0

$50,000

$50,000

2010 Withdraw $25,000*

(50/50 taxation)

$25,000

$50,000

$25,000

2011 Withdraw $25,000*

(50/50 taxation)

$0

$75,000

$25,000

2012 Withdraw $25,000*

(50/50 taxation)

$0

$50,000

$50,000

*10% premature penalty applies if under 59 ½ years of age

Distribution ordering rules

Assets must be distributed from Roth IRAs in a defined order. Annual contributions must be distributed

first, followed by taxable conversions, non-taxable conversions, and lastly earnings. In the event that a

Roth IRA owner has other assets held in Roth IRAs in addition to amounts converted in 2010, the indi-

vidual must determine (according to these ordering rules) what portion, if any, of a distribution in 2010 or

2011 was subject to the accelerated 2010 conversion taxation rules. Note that all Roth IRAs owned by the

individual must be taken into consideration.

Non-Roth employer plan conversions

In addition to conversions from Traditional, SEP, or SIMPLE (after two years from the first contribution

date) IRAs, the two-year ratable 50/50 taxation option was available for 2010 conversions from non-Roth

type employer-sponsored plans. The tax acceleration rules for pre-2012 distributions will also apply.

This information is for educational purposes only. It is always recommended that you seek the aid of a

competent tax advisor or tax attorney to assist you with tax advice and guidance.

2011 AND 2012 SAVER’S TAX CREDIT LIMITS

Under a provision in the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA),

certain individuals became eligible to receive a federal tax credit for retirement plan contributions in

addition to the tax deduction that may apply to the contribution. Although this provision was due to

expire December 31, 2006, the Pension Protection Act of 2006 (PPA ’06) made permanent this tax credit.

Retirement

Plans Quarterly

1st Quarter 2012