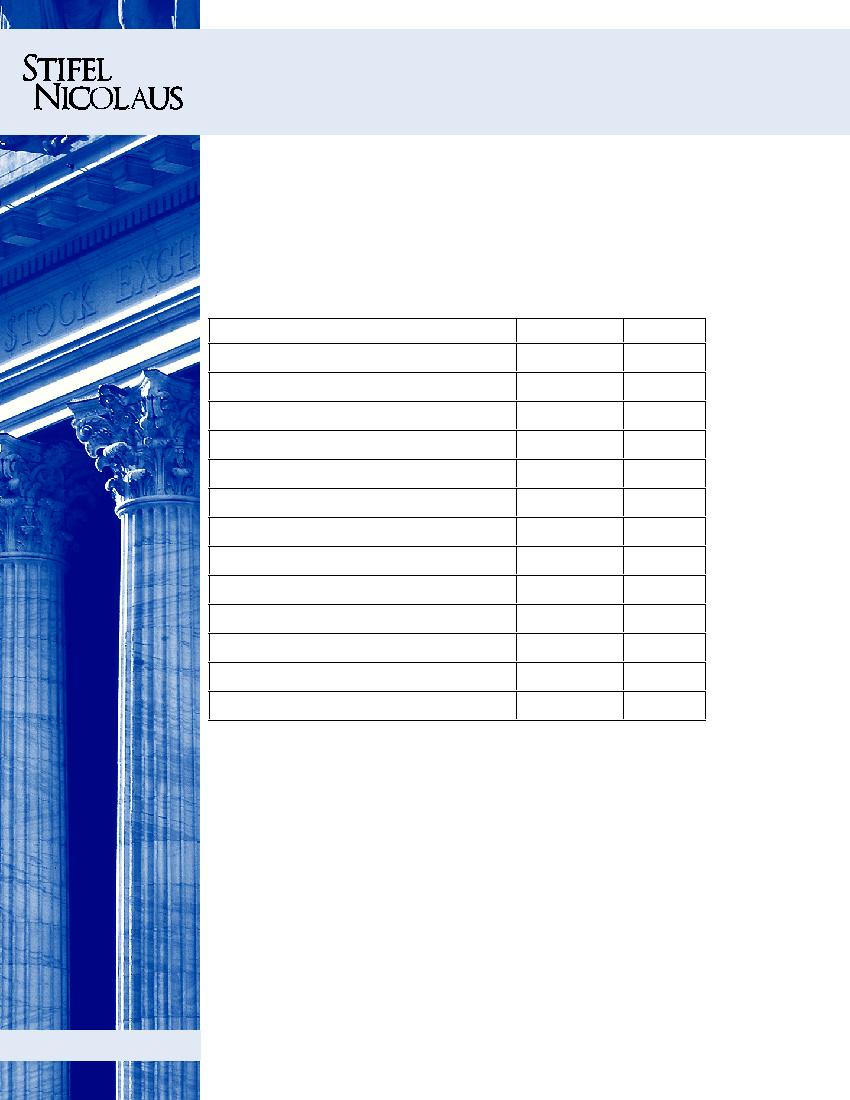

IRS ANNOUNCES COST-OF-LIVING ADJUSTMENTS FOR 2012

On October 20, the Internal Revenue Service announced cost-of-living adjustments applicable to dollar

limitations for plans and other items for tax year 2012. In general, many of the pension plan limitations

will change because the cost-of-living index met the statutory thresholds that trigger their adjustment.

However, other limitations will remain unchanged.

Annual Limit

2012

2011

Social Security Wage Base

$110,100

$106,800

Annual Compensation Limit

$250,000

$245,000

Key Employee Compensation Limit

$165,000

$160,000

HCE Compensation

$115,000

$110,000

Elective Deferral Limit (401(k), 403(b), 457)

$17,000

$16,500

Catch-Up Contributions (401(k) & 403(b))

$5,500

$5,500

SEP Minimum Compensation

$550

$550

SIMPLE IRA Deferral Limit

$11,500

$11,500

Catch-Up Contributions (SIMPLE IRA)

$2,500

$2,500

IRA Contribution Limit

$5,000

$5,000

IRA Catch-Up Contributions

$1,000

$1,000

Annual DB Benefit Limit

$200,000

$195,000

Annual DC Contribution Limit

$50,000

$49,000

IRA deductibility and Roth IRA eligibility are as follows:

Traditional IRA Deductibility: Income limits if covered by an employer-sponsored plan

Single Filer's AGI Married Filing Jointly AGI

Full Contribution <$58,000 <$92,000

Partial Contribution $58,000 - $68,000 $92,000 - $112,000

Not Eligible >$68,000 >$112,000

Maximum Joint Compensation for deductible contribution by non-covered spouse: $173,000 - $183,000

Single Filer's AGI Married Filing Jointly AGI

Full Contribution <$110,000 <$173,000

Partial Contribution $110,000 - $125,000 $173,000 - $183,000

Not Eligible >$125,000 >$183,000

Retirement

Plans Quarterly

4th Quarter 2011