WITHDRAWALS AFTER 2010 CONVERSIONS

Under a provision in the Tax Increase Prevention and Reconciliation Act of 2005 (TIPRA), as of January 1,

2010, the $100,000 AGI restriction has been eliminated for Roth IRA conversions. This will allow taxpayers

with AGI of $100,000 or more to convert their traditional, SEP, or SIMPLE IRAs (after two years), or retire-

ment plan assets to Roth IRAs in 2010 and beyond.

Tax considerations

Three key tax points should be addressed for those who are considering a conversion to a Roth IRA. First,

ordinary income tax will be due on all pre-tax dollars that are converted. Secondly, the year 2010 is the last

year for the current low income tax rates before they sunset in 2011. Thirdly, for conversions in the year 2010

(one year only) taxes can be deferred. Unless a taxpayer affirmatively elects full taxation in 2010, a 2010 Roth

IRA conversion will be taxed “ratably" by reporting 50% of the taxable amount converted on the 2011 return

and 50% on the 2012 return.

Accelerated taxation for distributions

TIPRA includes a provision intended to discourage the withdrawal of converted assets until their 2011 and

2012 tax obligations are satisfied.

Under the provision, if a 2010 converted amount is subsequently withdrawn in 2010 or 2011, the amount of

the distribution will be added as ordinary income to the IRA holder’s taxable income reported in the year of

the distribution. The same amount will be subtracted from the income that would have been reported in the

individual’s 2012 tax filing.

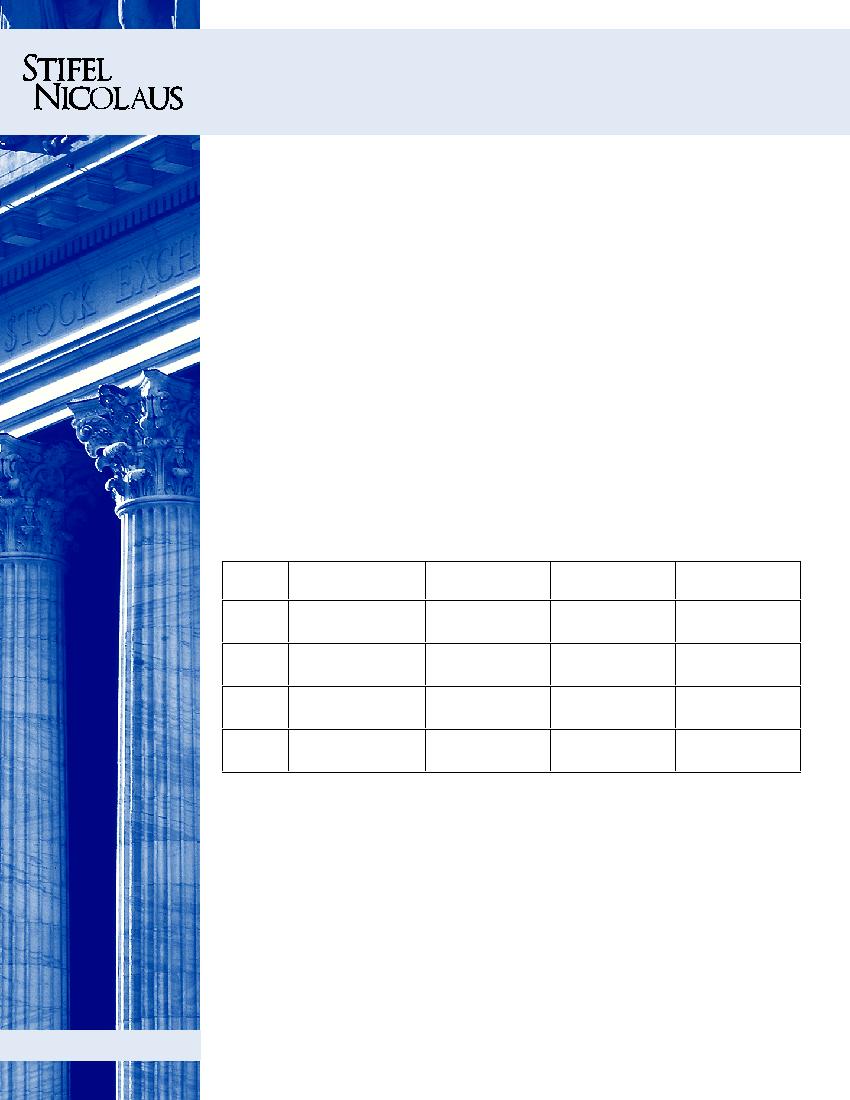

Accelerated Taxation for Pre-2012 Distributions

Year

Action

Income Reportable

in 2010

Income Reportable

in 2011

Income Reportable

in 2012

2010 Converted $100,000

(50/50 taxation)

$0

$50,000

$50,000

2010 Withdraw $25,000*

(50/50 taxation)

$25,000

$50,000

$25,000

2011 Withdraw $25,000*

(50/50 taxation)

$0

$75,000

$25,000

2012 Withdraw $25,000*

(50/50 taxation)

$0

$50,000

$50,000

*10% pre-mature penalty applies if under 59 ½ years of age

Distribution ordering rules

Assets must be distributed from Roth IRAs in a defined order. Annual contributions must be distributed first, fol-

lowed by taxable conversions, non-taxable conversions, and lastly earnings. In the event that a Roth IRA owner has

other assets held in Roth IRAs, in addition to amounts converted in 2010, the individual must determine (according to

these ordering rules) what portion, if any, of a distribution in 2010 or 2011 is subject to the accelerated 2010 conver-

sion taxation rules. Note that all Roth IRAs owned by the individual must be taken into consideration.

Non-Roth employer plan conversions

In addition to conversions from traditional, SEP, or SIMPLE (after two years from the first contribution date)

IRAs, the two year ratable 50/50 taxation option is available for 2010 conversions from non-Roth type

employer-sponsored plans. The tax acceleration rules for pre-2012 distributions will also apply.

Consideration for conversions

If an individual intends to do a 2010 conversion and anticipates a withdrawal of assets from the Roth IRA to

pay taxes due, it is highly recommended that the individual seek the aid of a competent tax advisor or tax at-

torney to determine if a conversion is the best course of action.

Retirement

Plans Quarterly

1st Quarter 2010