Income

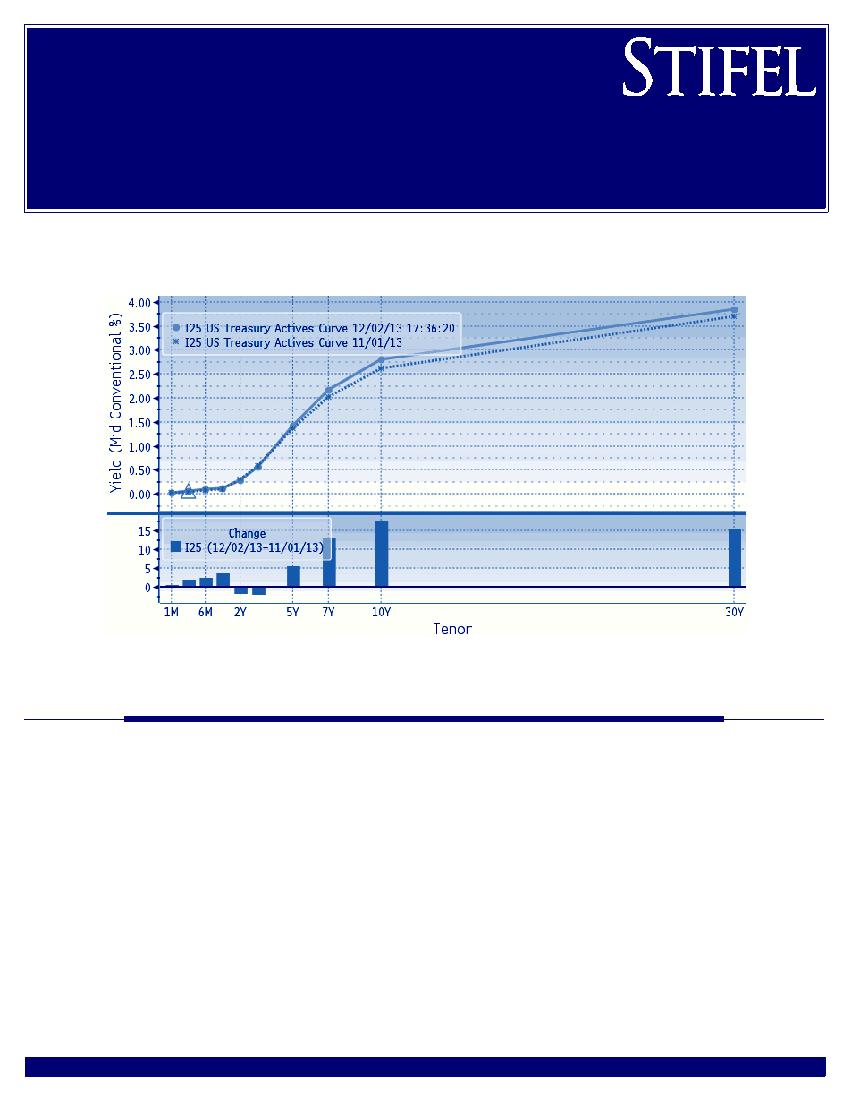

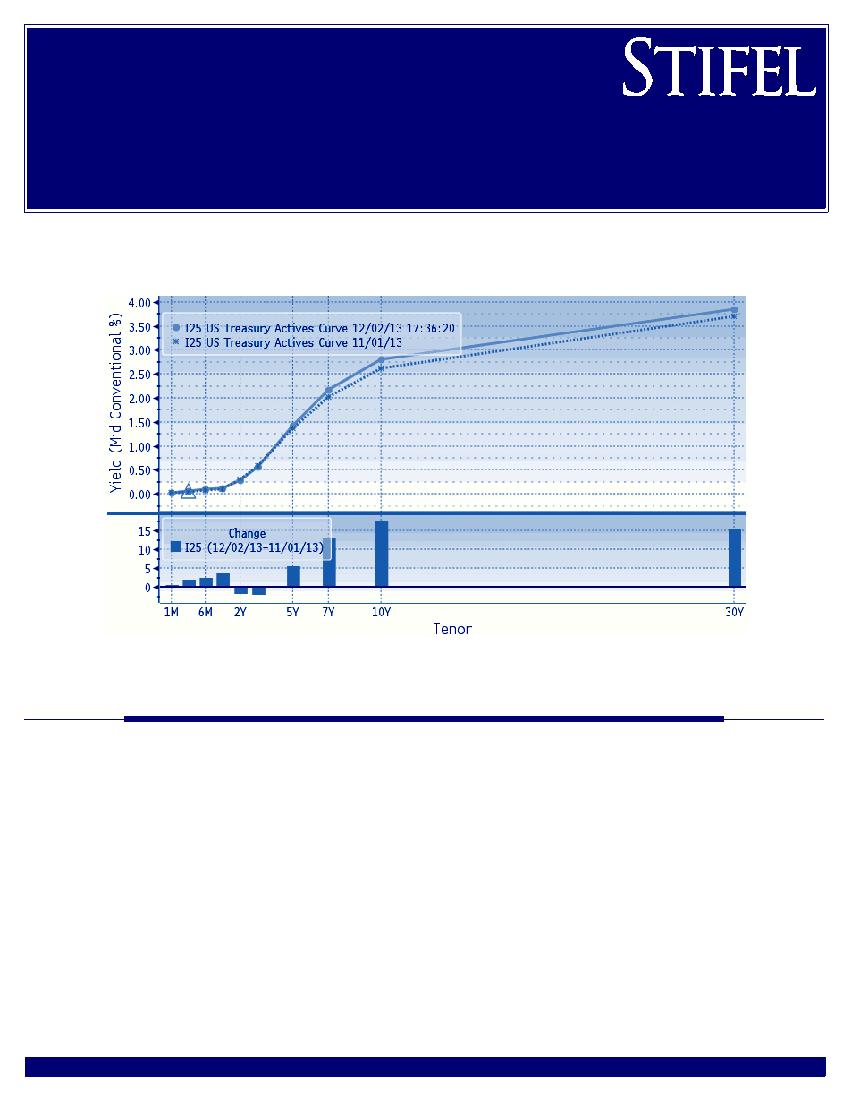

U.S. Treasury Yield Curve

Investment Selector

A Sampling Of What Is Currently Available Through Stifel

Source: Bloomberg

Bond Market Comments

Our research correspondent believes the key challenge for the

Federal Reserve in 2014 is to scale back the magnitude of its

asset purchase program (QE3) while fortifying its forward

guidance on low policy rates. They contend that the Fed cannot

continue purchasing MBS and Treasury debt at the current

$85 billion/month pace indefinitely, as this would risk taking

out a potentially disruptive share of debt issuance. But even as

it addresses these technical issues, the Fed still needs to convey

its intention to maintain a highly accommodative policy stance.

Our research correspondent’s base case is for the Committee

to announce a modest initial $10 billion taper early in 2014,

perhaps in January. They have penciled in a series of tapers

of increasing intensity, with an end to QE3 in September

2014. Another possibility is that, having whittled down QE3

to perhaps a quarter of its current size by next summer, the

Fed may choose to continue small and variable “maintenance

doses" of asset purchases through year-end and maybe into

2015. This idea warrants greater consideration if and when

Janet Yellen assumes the chairmanship, as it is our research

correspondent’s view that she would have a tendency to make

smaller, more frequent adjustments to policy than did Ben

Bernanke.