|

ROLLOVER

CENTER |

| |

|

| |

STIFEL NICOLAUS |

| |

|

|

Investment StrategistTM

International Investments:

A Key Component to Any Portfolio

June 2008

Increased globalization

has resulted in widespread economic growth throughout the world. In

today�s global economy, U.S. companies have expanded their reach to

serve a growing international client base. At the same time, more and

more of the products and services we use every day come from companies

that are based overseas.

As foreign economies

continue to expand, one way to potentially take part in their growth

is through international investing. While diversification does not

ensure against loss, diversification is key to any successful asset

allocation plan, and investing in foreign stocks offers a great way

for investors to round out a balanced portfolio. Foreign markets

generally lack correlation with our own stock market, meaning that

when one is down the other may be up. This can help counterbalance the

impact of fluctuations in the value of U.S. stocks in your portfolio

by spreading the risk.

Despite their many

strengths, foreign stocks are lacking in many investors� portfolios �

either due to lack of knowledge about foreign markets or apprehension

about the potential volatility involved. However, those who are

willing to perform the research necessary to make informed investment

decisions can potentially reap the rewards of taking on the risks of

international investing.

The Risks of

Foreign Investing

While international stocks

offer potential rewards, they also present many different forms of

risk, above and beyond those of domestic investments. These additional

risks make it critical that you do your homework and have a full

understanding of your own tolerance for risk before making foreign

investments.

Currency Risk

� International stocks are priced in the currencies of their home

markets. As such, their value to U.S. investors is affected by the

relative strength or weakness of the U.S. dollar. When the value of

the U.S. dollar is weaker, the value of foreign assets owned by U.S.

investors increases. A stronger U.S. dollar has an inverse effect,

lessening the value of foreign assets owned by U.S. investors.

Investors can potentially limit currency risk by holding their

investments over a longer period of time, as changes in the value of

the dollar tend to even out over time.

Country Risk

� The financial markets in some countries are

more volatile than others due to a variety of factors, such as

political instability, financial policies, war, natural disasters,

etc. The risk involved in investing in emerging markets (see below)

tends to be greater than that of more established markets.

Liquidity Risk

� The stock markets of developed

countries such as the United States and Great Britain are among the

most sophisticated in the world, allowing investors to make nearly

instantaneous transactions and receive up-to-the-minute information.

Not all financial markets, however, are this efficient. In developing

markets, extra care and consideration must be taken to help ensure

that transactions are processed in a timely manner.

Lack of Information � In the

U.S., publicly held companies are required to disclose their financial

performance and investors have access to a wide range of data for

research purposes. Other countries are not as stringent, making it

difficult to perform an analysis of a firm�s financial health.

V i s i o n

� P l a n n i n g

�

Focus

SNINS050801 |

|

|

|

International

Investments: A Key Component to Any Portfolio (continued) |

|

|

|

|

|

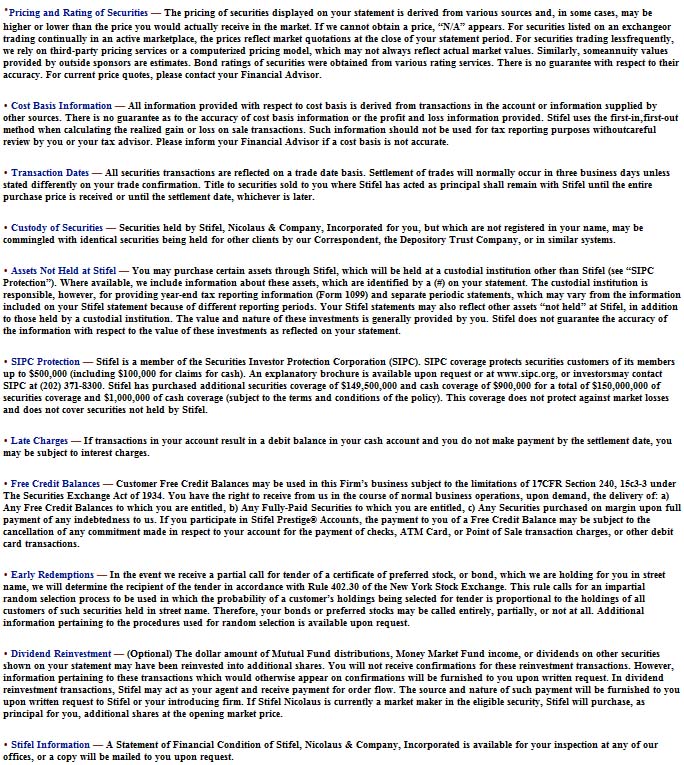

Selected International Indices vs.

the S&P 500 |

|

Calendar Year

Returns (Year-to-date figures are as of March 31, 2008) |

| |

YTD |

2007 |

2006 |

2005 |

2004 |

|

MSCI World Index |

-8.94% |

9.57% |

20.65% |

10.02% |

15.25% |

|

MSCI World Ex. U.S. Index |

-8.60% |

12.91% |

26.23% |

14.95% |

20.84% |

|

MSCI EM Latin America Index |

-1.39% |

50.67% |

43.48% |

50.42% |

39.62% |

|

MSCI EM Europe, Middle East, and

Africa Index |

-12.13% |

31.62% |

26.74% |

45.19% |

31.48% |

|

MSCI EM Asia Index |

-14.11% |

41.58% |

33.22% |

27.50% |

15.33% |

|

S&P 500 Index |

-9.44% |

5.49% |

15.79% |

4.91% |

10.88% |

|

Created with Zephyr StyleADVISOR. Returns assume reinvestment of

dividends but do not take into consideration fees, expenses, or

taxes. Past performance is not indicative of future results. The

MSCI World Index is designed to measure the equity market

performance of 23 developed markets in North America, Europe, and

the Pacific. The MSCI World Ex. U.S. Index is designed to measure

the equity market performance of 22 developed markets in North

America (excluding the United States), Europe, and the Pacific.

The MSCI EM (Emerging Markets) Latin America Index is designed to

measure the equity market performance of 6 emerging market country

indices in Latin America. The MSCI EM (Emerging Markets) Europe,

Middle East, and Africa Index is designed to measure the equity

market performance of 10 emerging market country indices of

Europe, the Middle East, and Africa. The MSCI EM (Emerging

Markets) Asia Index is designed to measure the equity market

performance of 9 emerging market country indices of Asia.The S&P

500 Index is generally considered representative of the U.S. large

capitalization market. Indices are capitalization-weighted,

unmanaged, and not available for direct investment. The

performance shown is for illustrative purposes only and is not

indicative of the performance of any specific investment.

|

|

|

|

Ways to Invest

There are several different ways to invest

in foreign securities, each offering certain advantages and differing

levels of complexity.

Individual Securities

� Shares of overseas companies that are not

available through an American market can be purchased on foreign

exchanges. These trades can be more expensive while possibly offering

less liquidity than a typical domestic trade, adding an extra layer of

complexity to the transaction.

American Depositary

Receipts � American depositary receipts

(ADRs) alleviate the need to purchase stocks on a foreign exchange,

giving investors easy access to international markets. ADRs can be

found listed on the New York Stock Exchange, the Nasdaq, and other

domestic stock exchanges and are bought and sold just like shares of

U.S.-based companies. And just like U.S.-based companies, foreign

companies with ADRs issue financial reports in conformance with SEC

regulations. Many major foreign companies offer ADRs.

Mutual Funds � Mutual

funds are a convenient way to invest in foreign markets, and many

mutual fund providers currently offer either actively managed

international funds or passively managed funds that seek to match the

returns of a specific international stock market index, such as the

Japanese Nikkei or the British FTSE.

While actively managed

mutual funds do not alleviate risk, the major advantage that they

offer is their simplicity, as a professional fund manager undertakes

the burden of selecting stocks and addressing the various risks

associated with international investing.

Mutual funds holding

foreign stocks can be broken down into four basic categories: global,

international, regional, and country.

Global Funds

� Hold stocks in companies all

over the world, including both U.S.-based stocks and foreign stocks.

International Funds � Invest solely

in the securities of companies based outside of the U.S.

Regional Funds � These funds focus on

a specific geographical region, such as Asia, offering diversification

by investing in multiple countries in the selected region.

Country Funds � Invest entirely in

securities issued by a single country.

Investors should

consider a fund�s investment objective, risks, charges, and expenses

carefully before investing. The prospectus, which contains this and

other important information, is available from your Financial Advisor

and should be read carefully before investing. The investment return

and principal value of an investment will fluctuate, so that an

investor�s shares, when redeemed, may be worth more or less than their

original cost.

Exchange Traded Funds � Similar to

index mutual funds, exchange traded funds (ETFs) seek to match the

returns of a specific stock market index. ETFs are bought and sold

just like stocks and typically offer lower fees than index funds. Both

are passively managed and experience low portfolio turnover. Tax

efficiency is also a key characteristic of both ETFs and index funds.

The main difference between the two lies in pricing. Index funds are

re-priced at the end of each trading day, while ETFs are priced

throughout the day, similar to stocks. They can also be sold short or

bought on margin. ETFs may also be especially attractive to investors

who wish to track a particular index for which there is no index fund

available. While ETFs do not charge sales loads, the purchase and sale

of ETF shares are subject to ordinary brokerage commissions.

Exchange Traded Funds

(ETFs) represent a share of all of the stocks in their respective

index held in a trust. Therefore, ETFs are subject to market risk,

including the possible loss of principal. The value of the portfolio

will fluctuate with the value of the underlying securities.

Investors should

consider an ETF�s investment objective, risks, charges, and expenses

carefully before investing. The prospectus, which contains this and

other important information, is available from your Financial Advisor

and should be read carefully before investing.

A Note on Emerging Markets

Further down the risk-reward spectrum are

emerging markets. While there is no overarching definition of an

emerging market, they are generally identified as possessing the

following characteristics:

Greater potential for political instability

Increased currency volatility

Lower per capita income

Countries falling into the category of emerging markets include

such economic powerhouses as China and India, as well as smaller

countries such as the Philippines. While emerging markets are

considered to be more volatile than their more highly developed

counterparts, their potential for growth is higher as well.

Getting Started in International

Investing

Your Stifel

Financial Advisor can introduce you to the wide variety of

international investments available to you and the role that they can

play in your portfolio. The percentage of foreign stocks that you

should have in your portfolio is entirely contingent on your unique

financial situation and your own personal tolerance for risk.

To better understand the

risks in your investments and discuss strategies for managing risk,

talk to your Financial Advisor today. The Asset Allocation Analysis

Report, through the Stifel PACT�

Program, can help you ascertain your tolerance for risk and develop an

asset allocation consistent with your needs and risk tolerance.

Stifel, Nicolaus & Company, Incorporated

� Member SIPC and New York

Stock Exchange

� One

Financial Plaza, 501 North Broadway, St. Louis, Missouri 63102

� www.stifel.com

|

|

|