|

ROLLOVER

CENTER |

| |

|

| |

STIFEL

NICOLAUS |

| |

|

|

Investment

StrategistTM

Say Goodbye to Stock Certificates

April 2009

|

Physical stock

certificates once were commonplace in the financial services

industry. However, new technology platforms and regulatory

changes have gradually moved investment firms and securities

issuers away from physical certificates and toward securities

issued and held in book entry form as part of an ongoing

dematerialization program. This is accomplished by holding

client account assets in �street name� or client name through

the Direct Registration System (DRS).s any concerns you may have with your

Financial Advisor, who can help you stay focused on your long-term

plans. |

|

Since the 1970s, the financial

services industry has used increasingly sophisticated book-entry

computer systems to handle millions of securities transactions

every day � swiftly, effortlessly, and safely. When you use the

book entry system, there is no longer any need for you to make

trips to a safe deposit box, or to run the risk or expense of

having paper certificates get lost, misplaced, stolen, or damaged

at home or in the mail. The majority of Stifel�s clients already

use book entry instead of paper certificates.

Another form of book entry is called

the Direct Registration System. DRS direct book entry was created

to provide shareholders the ability to move shares between

brokerage accounts and an issuer�s transfer agent without the

distribution of physical certificates. All member firms of the

Securities Industry and Financial Markets Association (SIFMA) have

been requested to discontinue providing physical certificates for

exchange-listed issues that are DRS-eligible. If the issuer whose

shares you hold or want to buy participates in DRS, you can use

this system to register your shares in your own name directly on

the books of the issuing company or a company designated by the

issuer to handle these transactions, called a transfer agent. You

will receive regular statements from the company (or the transfer

agent) showing your holdings.

Beginning January 1, 2009, the

Depository Trust & Clearing Corporation (DTCC) eliminated the

option to obtain a physical certificate for all DRS-eligible

issues.

Should you wish to obtain a physical

certificate for a security that is DRS-eligible, you will need to

contact your Financial Advisor and request that these shares be

sent to the transfer agent as DRS shares. The shares will then

leave your Stifel account and be moved electronically to an

account at the transfer agent in your name. There is no charge to

your Stifel account for this request. Once the shares have been

deposited to the transfer agent, that agent will mail you a

statement showing the shares held by the agent in an account in

your name. You can then contact the agent to obtain a physical

stock certificate directly from the transfer agent if this issuer

still offers physical stock certificates.

|

V i s i o n

�

P l a n n

i n g

�

F o c u s |

|

SNINS030901

|

Staying in the Market

|

|

|

|

In 2008, the S&P 500 fell by 37%, the

second-worst year in the history of that index. The markets have been

battered in 2009 as well, and even well-constructed, well-diversified

portfolios have taken a severe beating. But just because the value of

your investments may have taken a hit in recent months doesn�t mean

you should simply give up.

Maintain a Long-Term Focus

Over the course of investing for

long-term goals such as retirement, the market will certainly have its

share of ups and downs, but historically speaking, it has inevitably

recovered from its down periods (of course, past performance is no

indication of future results). Amid all of the negative headlines and

downbeat economic forecasts, it�s easy to panic � don�t. Stay calm,

maintain your long-term perspective, and don�t let emotions drive your

investment decisions. The overall impact of market volatility on your

investments will depend on your investment time horizon. For example,

if you have just a short time period before retirement, your portfolio

will have less time to recoup any losses sustained during a down

market. On the other hand, if you have a significant amount of time

before you need to access your investment funds, your portfolio is

much more likely to have fully recovered before that time.

|

Don�t Try to Time the Market

There�s an old saying that

successful investing may be derived from time in the market,

not market timing. Many experts will also agree that

determining the �best� time to get in or out of the market can

be nearly impossible, and that for most investors, trying to

time the market is not a practical investing strategy. Trying

to determine exactly when one should aggressively invest or

back out of the market takes a considerable amount of

expertise and time to monitor market environments. And even

the most savvy investors and advisors can�t guarantee that

their predictions will be correct, since there are no

guarantees when it comes to how the financial markets will

perform.

|

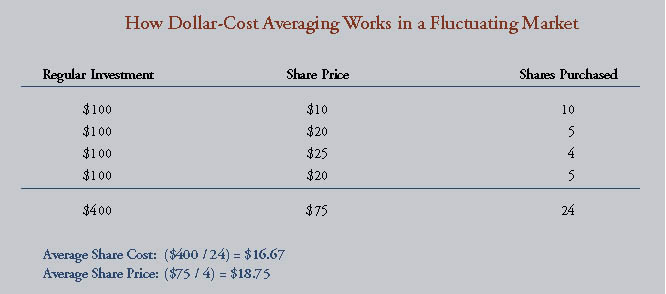

There is an advantage to staying in

the market for the long term, versus trying to determine specific

times to get in or out of the market. This advantage can best be

explained with the concept of dollar-cost averaging. Dollar-cost

averaging is simply investing equal or fixed amounts of money at

regularly scheduled intervals. With this investment strategy, you will

buy more shares when the price of your investment has declined, and

fewer shares when the price has risen. Over a period of time, you may

lower your average cost. Trying to predict when and how markets will

move can be nearly impossible and completely overwhelming. Whether you

are new to investing or a seasoned professional, dollar-cost averaging

can help you cope with price fluctuations in a volatile market.

By dollar-cost averaging, you may

reduce investment risk by not investing substantial amounts at the

wrong time. In addition, dollar-cost averaging forces you to invest on

a regular basis, as you would in a 401(k) plan, for instance. By

investing on a regular basis, you can avoid making bad decisions based

on emotions, such as the natural inclination to stop investing in a

weak market.

It is important to consider that

dollar-cost averaging does not assure a profit or protect against a

loss in declining markets. Before embracing the dollar-cost averaging

strategy, you should consider your ability to continue investing

during periods of falling prices.

-

Staying in the Market

Take Advantage of Buying Opportunities

A down market

doesn�t necessarily have to be a bad thing. You may be familiar with

the old saying �buy low, sell high.� During a market such as the one

we�re currently experiencing, many savvy investors are taking

advantage of attractive prices on stocks that were once considered

overvalued. Despite current economic conditions, there are still

strong, successful companies out there with the potential for future

gains.

Investors using dollar-cost averaging

will already be poised to take advantage of low prices. And, for those

who are not currently in the market, getting in at the bottom (or

close to it) may be the best time for new investors to enter. For

those investors who decide to halt their investing plans, or liquidate

their positions, they risk the opportunity to recoup their losses if

the market begins to recover. In addition, by getting out of the

market, an investor may miss some of the market�s best single-day

performances, as some financial experts believe that the most

profitable time of a bull market may be at the beginning.

|

Review Your Portfolio

Living through volatile market conditions can

be overwhelming. But you don�t have to go it alone. Your

Financial Advisor can help you understand what is happening

both with your portfolio and in the market. At Stifel, our investment philosophy is based on a century-old

tradition of providing solid, studied advice. With over a

hundred years of experience, we�ve been through all sorts of

market conditions and have the knowledge, perspective, and

experience to help you keep your investments on track during

difficult times. Taking a broader perspective on the market

can potentially pay off in the long run, so consult your

Stifel Financial Advisor with any concerns you may have

regarding today�s market conditions.

|

|

- Account

Disclosures

Stifel, Nicolaus & Company, Incorporated

� Member SIPC

and New York Stock Exchange

� One Financial

Plaza, 501 North Broadway, St. Louis, Missouri 63102

�

www.stifel.com

|

|

|