|

ROLLOVER

CENTER |

| |

|

| |

STIFEL

NICOLAUS |

| |

|

|

Investment

StrategistTM

Should Municipal Bonds Be a Part of Your

Portfolio?

February 2009

|

Investing in the stock market over time has historically

proven to be the best place for investors to beat inflation.

However, recent market volatility has caused many investors to

seek out safer alternatives to stocks. Municipal bonds are

particularly popular these days, offering attractive yields in

addition to a predictable stream of tax-free income, generally

coupled with a high degree of stability with regard to payment

of interest and repayment of principal.

While municipal bonds can play an

integral role in a well-diversified portfolio, investors

should fully understand their characteristics before

investing. Municipal bonds are often deemed a �safe�

investment; however, investors need to be aware that bonds,

like all investments, do carry some risk, and those risks need

to be considered carefully.

|

|

Municipal Bond Basics

Just as the federal government needs

funds to operate, local governments and public entities, such as

school districts, often issue municipal bonds to meet their financial

needs. Municipal bonds can be issued by states, cities, towns, or

public commissions to provide money for schools, hospitals, and other

public works. These securities provide income that is free of federal

and, in some cases, state and local taxes. Certain issues may be

subject to the alternative minimum tax. (Although income generated by

most municipal bonds is exempt from taxes, any capital gains earned

from the sale of bonds are subject to all federal and most state tax

laws.)

When an investor buys a municipal bond,

he or she is, in fact, loaning money for a certain period of time to

the issuer of the bond. In return for loaning funds, the investor

receives the principal amount back, with a specified amount of

interest (usually paid annually or semi-annually), at the time the

bond comes due or �matures.�

A bond�s face value, or the price at

issue, is known as its �par value,� and the interest payment is known

as its �coupon.� The price of bonds will fluctuate, similar to stocks,

throughout the trading day. However, with most municipal bonds, the

coupon payment will stay the same. If an investor purchases a

municipal bond in the secondary market at the face value, the bond is

considered to be sold at �par.� If a bond�s price is above its face

value, it is sold at a premium. If a bond�s price is below face value,

it is sold at a discount.

The two basic types of municipal

bonds are:

General Obligation Bonds

� Principal and interest are

secured by the full faith and credit of the issuer and usually

supported by either the issuer�s unlimited or limited taxing power.

General obligation bond issues are voter-approved.

Revenue Bonds

� Principal and interest are

secured by revenues from tolls, charges, or rents paid by users of the

facility built with the proceeds of the bond issue. Public projects

financed by revenue bonds include toll roads, bridges, airports, water

and sewage treatment facilities, hospitals, and housing for the

poor. Many of these bonds are issued by special authorities created

for the purpose.

|

V i s i o n

�

P l a n n

i n g

�

F o c u s |

|

SNINS010901 |

Should

Municipal Bonds Be Part of Your Portfolio?

|

|

|

|

Understanding Yields

As previously mentioned, the

coupon rate is the interest rate paid on a bond. This amount

is expressed as a percent of par value, $100.00 or $1,000

(municipal bonds are usually purchased in increments of

$5,000). For example, a 6% coupon would indicate that the

annual interest paid on a bond is $60. The current yield rate

indicates the current rate of return an investor will receive

on each dollar invested, without any adjustments for

differences between the purchase price and the maturity value.

The current yield rate is useful when comparing current yields

on various income-producing investments. The yield to maturity

rate indicates the overall rate an investor will earn,

including adjustments for any differences between the purchase

price and the maturity value. The yield to call rate indicates

the overall rate an investor will earn, including adjustments

for any differences between the purchase price and the call

price, in the event the bonds are called by the issuer. It is

important that investors make note of the yield to maturity

and yield to call on any bonds they are considering

purchasing.

|

|

Bond Laddering

Investors can never be completely certain

as to where yields on municipal bonds are headed. A popular way for

investors to help balance risk and return in a bond portfolio is to

utilize a technique called laddering. To build a laddered portfolio,

investors purchase a collection of bonds with different maturities

spread out over their investment time frame. By staggering maturities,

investors may be able to reduce the impact that changes in interest

rates can have on their portfolio.

For example, an individual who wishes to

create a laddered portfolio could purchase bonds that mature each year

during a span of ten years. By using a rollover strategy as well, when

the first bond matures, the investor could reinvest those funds in a

bond that matures in ten years. As each bond matures, the investor

would continue this process. After ten years, the investor would own

all ten-year bonds, with one maturing every year. By laddering the

bond portfolio, an investor can worry less about fluctuations in

interest rates. If interest rates rise, the investor knows that he or

she will soon have money available from a maturing bond to take

advantage of a new bond. If interest rates should fall, then the

investor has at least managed to secure higher rates for a portion of

their portfolio. This strategy can also be used with certificates of

deposit (CDs).

The Effect of Taxes on an

Investment

Many investors find municipal bonds

attractive because of their tax advantages. However, it is important

for investors to compare tax-advantaged bonds to taxable investments

in order to determine the best investment for their situation.

In order to compare rates of return on

investments, it is helpful to adjust the tax-free rates to their

�taxable equivalent� rates. This is the taxable rate that would have

to be earned in order to net the same tax-free rate, after paying

federal income taxes. To calculate the taxable equivalent rate, simply

divide the tax-free rate by one minus your federal tax bracket rate.

For example: Assuming an investor�s

federal marginal tax bracket is 28% and an investment offers a

tax-free rate of 4%, the taxable equivalent rate would be 5.56%. (4%

/1-.28 = 5.56%)

Based on this calculation, the investor would have to

earn 5.56% on an investment that was subject to federal income

taxes to net the same 4% that the tax-free investment offered.

-

Should Municipal Bonds Be Part of Your Portfolio?

Knowing the Risks

While the income

generated by bonds is generally �fixed,� it is important to know that

the same is not true for a bond�s return. There are many risks that

may affect a bond�s return. These risks include:

Inflation risk

� Due

to the fact that most bond interest payments are fixed, their value

can be depleted by inflation. Therefore, the longer the term of the

bond, the greater the inflation risk.

Interest rate risk

� The

prices of bonds move in the opposite direction of interest rates. When

interest rates rise, prices of outstanding bonds fall. This is because

newer bonds will be issued paying higher coupons, which makes the

older, l ower-yielding bonds less attractive. On the other hand, when

interest rates fall, prices of outstanding bonds will rise.

Call risk

�

Many municipal bond issuers have the right to redeem or �call� their

bonds at a premium before they have matured.

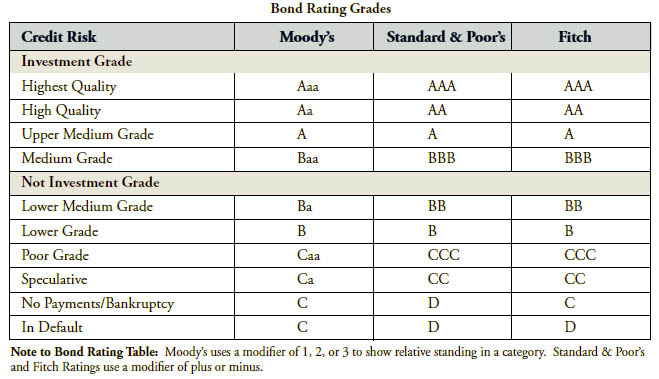

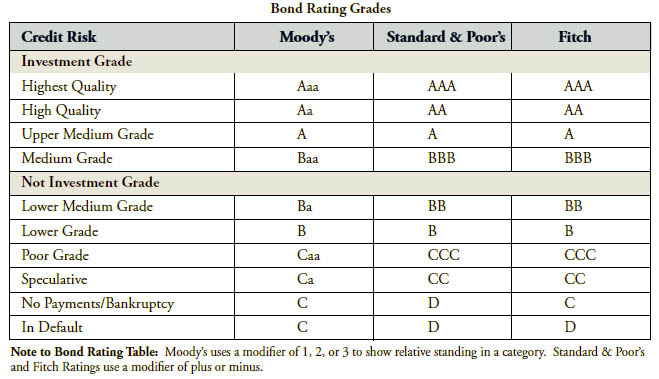

Credit risk

�

Because a bond is a debt instrument, there is a risk that the bond

issuer will be unable to make its payments on time, or at all. To

assist in the evaluation of the creditworthiness of municipal bond

issuers, ratings agencies such as Moody�s, Standard & Poor�s, and

Fitch Ratings analyze bond issuers� ability to meet their debt

obligations and issue ratings accordingly. Municipal bonds have

historically been of high credit quality, due to the fact that state

and local governments have had much lower default rates than corporate

bond issuers.

|

Liquidity risk

�

Bonds, in general, do not offer the liquidity that stocks provide.

When purchasing a bond, investors need to remember that they

generally should be considered a longer-term investment.

Market risk

�

Because the rate on most municipal bonds is fixed, the market

value of these investments will fluctuate over time, reflecting

current changes in interest rates. Bonds follow the laws of supply

and demand. The more popular or less plentiful a bond, the higher

the price it can command in the market. Prices on bonds sold prior

to maturity may be higher or lower than the purchase price.

Diversify With Municipal

Bonds

Municipal bonds

can be important part of an asset allocation mix and can be useful

in diversifying your portfolio. Determining how much of your

portfolio should be allocated to bond investments will be based

upon your long-term financial goals and objectives, your tolerance

for risk, investment time horizon, and ability to invest. To learn

whether investing in municipal bonds is right for you, contact

your Financial Advisor today.

Account Disclosures

|

|

Stifel, Nicolaus & Company, Incorporated

� Member SIPC and New York

Stock Exchange

� One

Financial Plaza, 501 North Broadway, St. Louis, Missouri 63102

� www.stifel.com

|

|

|

|