|

ROLLOVER

CENTER |

| |

|

| |

STIFEL

NICOLAUS |

| |

|

|

Investment

StrategistTM

Recessions and Bear Markets

January 2009

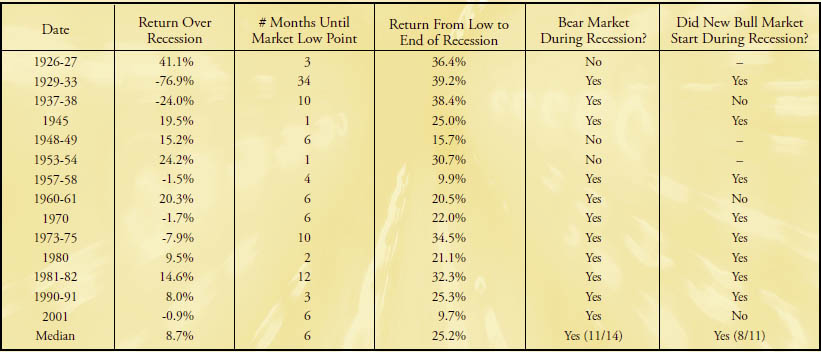

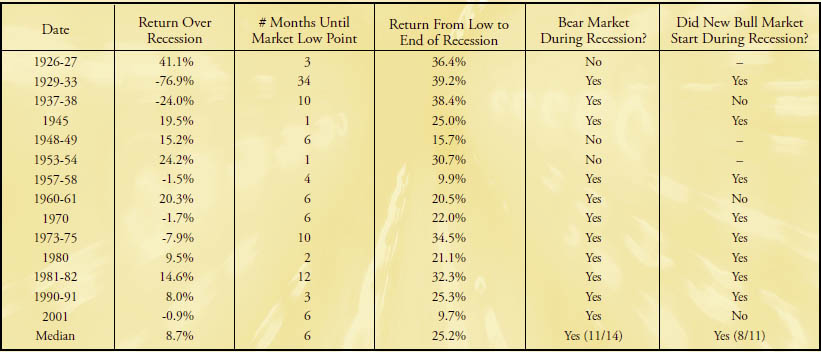

In late November, the National Bureau of

Economic Research (NBER) confirmed what most of us already knew � that

the U.S. has been in a recession since December 2007. The NBER defines

a recession as a significant decline in economic activity spread

across the economy, lasting more than a few months.

So what does that mean for the stock

market? Past performance is no guarantee of future results, but a

review of historic recessions reveals some interesting patterns.

According to statistics from Fidelity Investments, the typical pattern

is for new bull markets to begin during � as opposed to after �

periods of economic weakness.

Discuss any concerns you may have with your

Financial Advisor, who can help you stay focused on your long-term

plans.

2008 Annual Fair Market Value Statement

Attention: All IRA account

holders (including IRAs, ESAs, SEP, and SIMPLE accounts with

Stifel as Custodian)

As the custodian of your IRA,

Stifel is required to supply you with an Annual Fair

Market Value Statement prior to January 31, 2009. Please consider

the enclosed year-end statement as your 2008 Annual Fair Market

Value Statement. The �Total Net Portfolio Value as of December 31,

2008,� excluding assets not held at Stifel, will be forwarded to

the IRS.

|

Tax Reporting Update

The IRS has extended the due date for

distribution of 1099B, 1099S, and certain 1099-Misc forms

until February 15, 2009, instead of the traditional

requirement of January 31, 2009. The extension currently

does not appear to include other forms included with

Stifel�s Consolidated Reporting Statement, such as the

1099-DIV, 1099-INT, or the 1099-OID. In order to eliminate

the confusion and inefficiency of multiple mailings,

Stifel has applied for an extension to file for all

required customer filings for the 2008 Tax Reporting

Season. We will distribute to our clients all 1099

reporting information by the February 2009 due date. The

1099R and 1099Q will be mailed, as is customary, by

January 31, 2009.

|

|

V i s i o n

�

P l a n n

i n g

�

F o c u s |

|

SNINS120801 |

Stifel Consumer and Online Privacy Policy

|

|

|

|

Protecting Your Privacy � Our Pledge to

You

Stifel Financial Corp. and our

affiliates* believe the opportunity to help you meet your financial

objectives is a great privilege and carries with it a great

responsibility. Protecting the confidential information of our current

and former clients is very important to us. With this in mind, Stifel

Financial Corp. and all our affiliates will be governed by the

following privacy principles.

1. Your privacy is a top priority.

As we work together, you often entrust us

with personal and financial information, such as your name, address,

occupation, assets, income and debts, and tax information. In the case

of insurance products, you may also entrust us with health

information. We use information given by you to provide products and

services to you, to help you achieve your financial goals, and to

communicate better with you. We promise to protect the security,

privacy, and use of your personal and financial information, including

account and transaction details.

We may collect information from you in

person, on the telephone, through regular mail, or through electronic

means, such as sending Stifel an e-mail message or requesting services

through the Stifel web site. Stifel does not collect any personal

information from anyone who is merely visiting or browsing our web

site.

2. Opening a new account at Stifel.

To help the government fight the funding

of terrorism and money laundering activities, federal law requires all

financial institutions to obtain, verify, and record information that

identifies each person who opens an account. What this means to you:

When you open an account, we will ask for your name, address, date of

birth, and other information that will allow us to identify you. We

may also ask to see your driver�s license or other identifying

documents.

3. The products and services you use are

delivered in a secure environment.

When you use the Internet to access your

Stifel account, you can feel confident that we use security measures

that are appropriate to protect personal and financial information.

4. Keeping your personal information

accurate and current is a vital concern.

We strive to keep your personal and

financial information accurate. If you believe that our records are

incorrect or out of date, please notify us. We will make any necessary

corrections quickly.

5. Employee access to your information is

limited.

Stifel employees have limited access to

client information based on their job function. This enables them to

assist you in your transactions, offer additional financial services,

and resolve problems that might arise. All employees are instructed to

use strict standards of care outlined in our Code of Conduct.

Employees not adhering to these standards of conduct are subject to

disciplinary action including dismissal.

6. Your information is shared only in

limited ways and for specific purposes.

We may share your information with Stifel

affiliates or with nonaffiliated companies outside Stifel to

facilitate your transactions. Examples of nonaffiliated companies may

include financial service companies, such as mutual fund or insurance

companies. Other nonaffiliated companies may include companies we have

contracted with to provide services on our behalf, such as statement

and report printers, data processing vendors, computer software

maintenance, transaction clearing firms, or third parties to

distribute annual reports and proxy statements. We may share your

information to implement security measures and fight fraud for your

continued protection. We may also supply the most current and accurate

information to credit bureaus or similar organizations.

7. Other than disclosing information to

third parties that perform certain transactions on your behalf, we do

not reveal your information to nonaffiliated third parties unless we

have previously informed you in disclosures or agreements, have been

authorized by you, or are required by law.

8. If we share information with Stifel

affiliates or other companies, they must agree to maintain the

confidentiality and security of your information and to use it for the

specific purpose identified by us.

9. Stifel does not rent or sell any

client information collected through its web site or other means to

any third-party marketers.

10. Stifel will continue to provide you

notice of our privacy policy annually, as long as you maintain an

ongoing relationship with us.

This policy may

change from time to time. You may review our current policy on our web

site at www.stifel.com. When you access our web site, your information

is protected through various forms of Internet security, such as

passwords, data encryption, and Secure Socket Layers (SSL) technology.

* Affiliates

include Stifel, Nicolaus & Company, Incorporated, Stifel Bank & Trust,

Choice Financial Partners, and Stifel Independent Advisors, LLC

Stifel Independent Advisors, LLC is an introducing firm and uses Stifel as

its clearing firm.

-

Mutual Fund and Annuity Compensation

Understanding How Stifel and Your

Financial Advisor Are Compensated

Stifel and our Financial Advisors receive

compensation when clients invest in mutual funds and annuities.

Depending on the available share class, compensation may be the result

of a front-end sales charge, a concession from a mutual fund or

insurance company, ongoing servicing fees (commonly referred to as

12b-1 fees), or a fee if mutual funds are purchased in a Stifel

fee-based account. You should discuss with your Financial Advisor the

form of compensation he or she receives.

Stifel may also receive other networking,

processing, marketing, or operational 12b-1 fees from companies on an

annual basis, including the Dreyfus money market funds, and some

mutual fund and annuity companies pay or make contributions to Stifel

for employee training and educational meetings, due diligence, and/or

promotional activities. Our Financial Advisors are not required to

recommend those investment products, nor do they directly share in any

of the marketing support fees received.

Additionally, Stifel may on occasion

receive commissions as compensation for executing trades on behalf of

mutual funds and annuities.

Please visit our web site,

www.stifel.com, for additional information, or see the

prospectus, Statement of Additional Information, or issuer web site

for a particular investment.

|

Important Information

Regarding Purchasing Securities on Margin

Stifel,

Nicolaus & Company, Incorporated is furnishing this

information to you to provide some basic facts about

purchasing securities on margin and to alert you to the risks

involved with trading securities in a margin account. Before

trading securities in a margin account, you should carefully

review the margin agreement provided by Stifel. Consult your

Financial Advisor regarding any questions or concerns you may

have with your margin account(s).

When you purchase securities, you

may pay for the securities in full or you may borrow part of

the purchase price from Stifel. If you choose to borrow funds

from Stifel, you will open a margin account with the firm. The

securities purchased are Stifel�s collateral for the loan to

you. If the securities in your account decline in value, so

does the value of the collateral supporting your loan. As a

result, Stifel can take action, such as issue a margin call

and/or sell securities in your account, in order to maintain

the required equity in the account.

It is important that you fully

understand the risks involved in trading securities on margin.

These risks include the following:

You can lose more funds than you deposit

in the margin account.

A decline in the value of securities that

are purchased on margin may require you to provide additional

funds to Stifel to avoid the forced sale of those securities

or other securities in your account.

Stifel can

force the sale of securities in your account.

If the equity in your account falls below

the maintenance margin requirements under the law, or Stifel�s

higher �house� requirements, Stifel can sell the securities in

your account to cover the margin deficiency. You also will be

responsible for any remaining shortfall in the account after

such a sale.

Stifel can

sell your securities without contacting you.

Some investors mistakenly believe that a

firm must contact them for a margin call to be valid, and that

a firm cannot liquidate securities in their accounts to meet

the call unless a firm has contacted them first. This is not

the case. Most firms will attempt to notify their clients of

margin calls, but they are not required to do so. However,

even if a firm has contacted a client and provided a specific

date by which the client may meet a margin call, the firm can

still take necessary steps to protect its financial interests,

including immediately selling the securities without notice to

the client.

You are not

entitled to choose which security in your margin account is

liquidated or sold to meet a margin call.

Because the securities are collateral for

the margin loan, Stifel has the right to decide which security

to sell in order to protect its interests.

Stifel can increase its �house�

maintenance margin requirements at any time and is not

required to provide you with advance written notice.

These changes in firm policy often take

effect immediately and may result in the issuance of a

maintenance margin call. Your failure to satisfy the call may

cause Stifel to liquidate or sell securities in your account.

You are not

entitled to an extension of time on a margin call.

While an extension of time to meet margin

requirements may be granted to clients under certain

conditions, a client does not automatically have a right to

the extension.

|

|

____________

Order Routing Information

______________

The identity of the

trading venues to which your orders were routed for execution and

the time of any resultant transactions is available, upon request,

for the six months prior period.

Account Disclosures

|

Stifel, Nicolaus & Company, Incorporated

� Member SIPC

and New York Stock Exchange

� One Financial

Plaza, 501 North Broadway, St. Louis, Missouri 63102

�

www.stifel.com

|

|

|